Entrepreneurship, it's not a walk in the park. High inflation, rising interest rates and the resource & energy crisis. It's all part of it. Take electricity: the price of 1kWh at its peak reached as much as four times the original rate. Meanwhile, that price dropped to half again, but that still means a price increase of 100% today. Constant rate changes are a new reality for any organization.

And that economic situation raises questions for many people:

- Am I still making money?

- Should I raise my price and how much?

- Can I still invest or should I cut back?

- Should I partially or temporarily shut down my production?

- On which products and services do I earn the desired margin?

- Should I shift my focus?

At Titeca pro accountants & experts in response, we formulated a roadmap that will help you score in today's reality.

- Know and name your added value

- What does your organization stand for?

- What is your greatest strength?

- Why does a customer choose you and not the competition?

Put your strategy & vision and communicate it clearly with your employees and customers. This will not only set you apart from your competitors, but it will help you through all the changes the right course retain. It's also important for your employees. Because if they understand where you want to go as an organization, they can contribute even more impactfully. In addition, if your customers also see, experience and appreciate the added value of your products or services, they will understand the price you charge for them.

More info? Our strategic experts help you with this.

2. Clarify your cost structure

This is perhaps the most important step! Using Titeca, lay open your cost structure and break down between fixed, variable and semi-fixed costs. This makes it very clear exactly what impact price increases have, which product or service you earn how much from and how you can maintain your profit (margin).

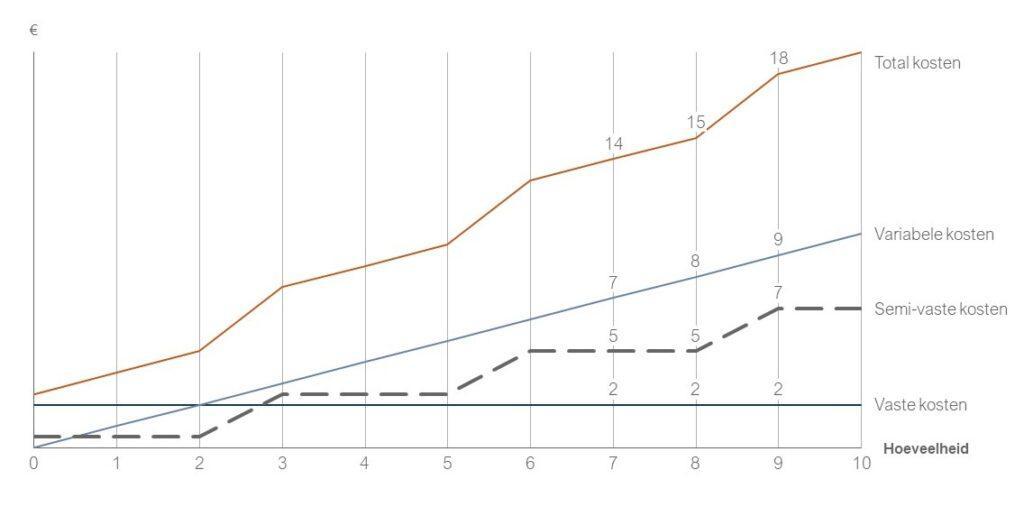

Fixed costs: Costs that remain quasi the same when you produce more or less.

- rent, permanent staff salaries, administrative costs, maintenance & repairs, ...

Variable costs: Costs that depend on the number of units sold.

- raw materials, interim personnel, packaging, subcontracting, ...

Semi-fixed costs: In reality, we see that there are also semi-fixed costs. Every fixed cost is actually a semi-fixed cost, which can rise or fall depending on large variations in production in typical plateaus. That cost is much less sensitive than true variable costs.

- rental additional warehouse, commissions, staff expansion, ...

Gain: very simple ... when you subtract all costs from your sales and get a positive result, you have made a profit. We call the profit percentage return.

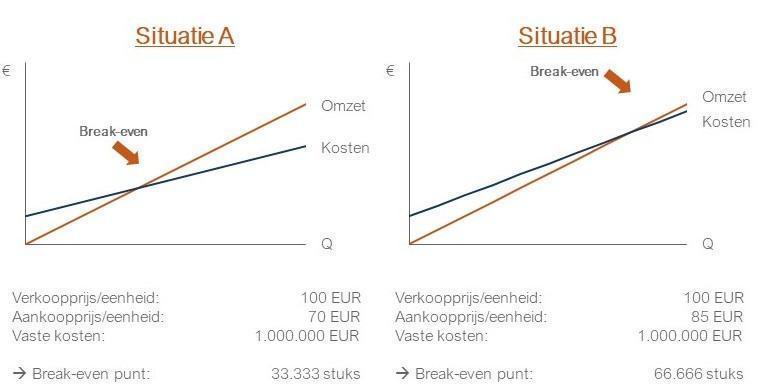

Break-even point: the point at which all fixed costs are covered and you can start making a profit. The lower the break-even point, the faster you make a profit. Your break-even point rises when fixed costs increase and you don't raise the selling price. Then you will have to sell more to make a profit. If you choose to increase prices, your break-even point will decrease again and you can cover all your costs faster.

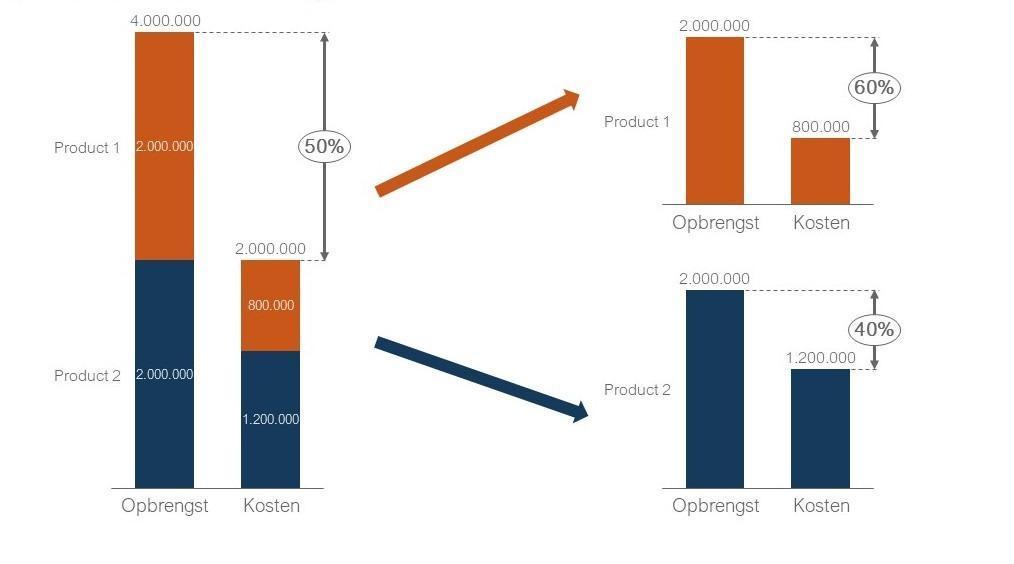

Together with you, we at Titeca tackle this complex issue, make sure you have a clear overview have of your costs and calculate what action you need to undertake to be financially healthy in the future. And more than that, we also look at exactly which services and products you use to make money and help you to reasoned choices to make based on the numbers.

3. Take action

Embrace the new reality, do not dwell on the past and focus on the new opportunities now.As a business leader, you are a role model. Take action to keep growing, evolving and surviving.

Chances are you will have to raise your prices to do so. For example, you may choose to raise one-to-one calculation and guard your profits. Or you can also use the pass on costs with margin, so that you can also maintain your effective profit percentage (return). Check with your customer manager what costs are involved, how to factor them in and how best to communicate with your customers. We are there for you every step of the way.

Want to learn more about how to monitor your profits? Then make an appointment with our strategy experts here!