Soon you will receive the first quarterly statement for your provisional social contributions as a self-employed person. Due to the high inflation in Belgium, these contributions have not been spared either. In this article we explain once again how your social contributions are calculated and what the exact effect of inflation is on this.

Also, how are social contributions of a self-employed person calculated?

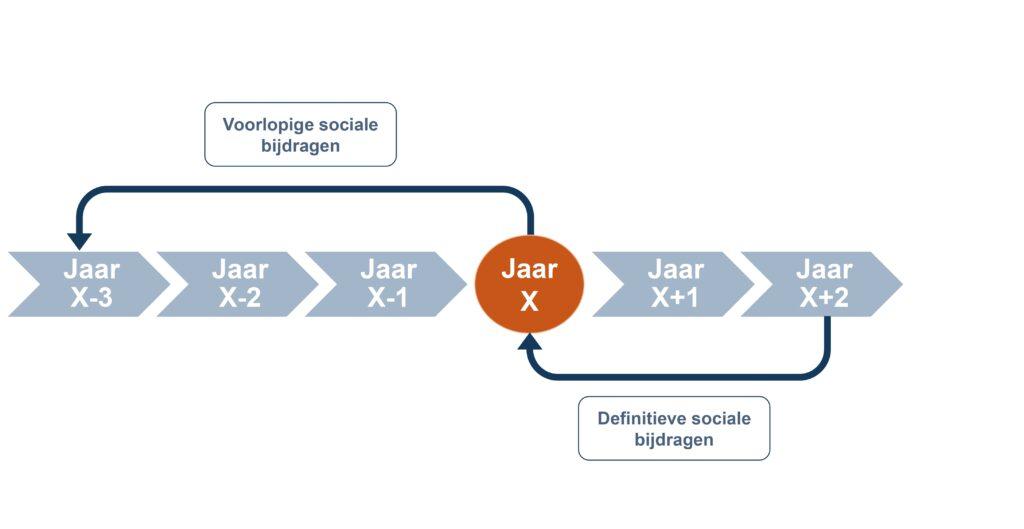

As long as your actual income is not yet known, as a self-employed person you will pay provisional social contributions. If you have been self-employed for more than three years, these contributions are calculated on the basis of your indexed net taxable income from three years before (Year X-3).

The moment your actual income is known, a final statement. Usually this settlement comes two years after the income year to which the social contributions relate (Year X+2).

If it turns out that you have already paid sufficient provisional contributions, you will not have to pay anything extra and you may even get a certain amount back. If your actual income is much higher than the basis on which your provisional social security contributions were calculated, you will still have to make an additional payment afterwards.

What about provisional social contributions in 2023?

The 2023 provisional social contributions are thus calculated on the basis of the 2020 indexed net taxable income. Due to high inflation, the indexation coefficient is exceptionally high this year, specifically 18.31% (relative to 6.47% in 2022).

What is the concrete effect of this indexation on your provisional contributions?

Example: In 2020, your net taxable income was EUR 40,000. Your provisional contributions will be calculated at an amount of EUR 47,325.48 (40,000 EUR x 18.31%). In 2023, you will therefore make a provisional quarterly contribution of EUR 2,499.41 pay. This is calculated as follows:

- EUR 47,325.48 x 20.5% = EUR 9,701.72

- 9,701.72 EUR x 3.05% (notional management cost social secretariat) = 295.90 EUR

- EUR 9,701.72 + EUR 295.90 = EUR 9,997.62

- 9,997.62 EUR / 4 = 2,499.41 EUR

Is there an impact on your final social contributions?

Although inflation is very noticeable when calculating your provisional contributions, this will no direct effect have on the final social contributions that you pay as a self-employed person.

At the final statement your actual income in 2023 will still be taken into account. If this is equal or even lower than the income on which your provisional social security contributions were calculated, you will be refunded the difference.

For example: Suppose your actual net taxable income in 2023 is the same as in 2020 (i.e., EUR 40,000), your final contribution will be EUR 2,112.53.

- EUR 40,000 x 20.5% = EUR 8,200

- 8,200 EUR x 3.05% (notional management cost social secretariat) = 250.1 EUR

- EUR 8,200 + EUR 250.1 = EUR 8,450.1

- 8,450.1 EUR / 4 = 2,112.53 EUR

Given that you have made provisional contributions in the amount of EUR 2,499.41, you will be refunded the difference between this amount and your final contribution.

Is there anything you can do about this increase?

We realize that such increases in social contributions can put considerable pressure on your financial situation as a self-employed person. After all, the calculation of these contributions assumes that your actual income will eventually index as well. Just know that, as mentioned above, you will have to pay the any overpayments amount will recover at your final statement.

Furthermore, you also have the option of a reduction of your social contributions to request.

Caution: only apply for this reduction if you are certain that your income in 2023 will effectively be lower than your income in 2020! When estimating your income, you must take into account that certain components (including benefits in kind) are also in line with inflation. If it turns out at the final settlement that your actual income in 2023 is a lot higher, your contributions will be increased retroactively and any late payment interest will be due.

Do you have questions about the impact on your business?Don't hesitate to contact us here contact us with questions.

Wish to have a conversation about the right approach for your business?Then make an appointment with ourproexperts!