In order to give the economic recovery a boost, the federal government has introduced a new temporary NSSO reduction, also known as a "target group reduction". Specifically, a reduction in the employers' social security contributions is provided for each employer whose employment increased in the third quarter compared to the first quarter of this year. In addition, specific target group reductions are also provided for the hotel, travel and events sector.

1. General target group reduction in the event of an increase in labor volume

What are the conditions?

Employers who saw the number of hours worked in their company increase in the third quarter of 2021 compared to the first quarter are entitled to a NSSO rebate. For example, the number of hours worked may increase because they have phased out the regimes of temporary unemployment, and/or they have hired additional staff.

Specifically, the number of hours worked must have increased by at least:

- In an enterprise with less than 50 employees: 25%

- In an enterprise with 50 to 499 employees: 20%

- In an enterprise with at least 500 employees: 10%

In addition, employers who want to enjoy the rebate may do so in 2021:

- Not announcing collective dismissal

- Not awarding dividends to shareholders and not awarding bonuses to the executives and directors in the company

And must also provide at least 2 training days for each employee, subject to more stringent provisions in the sectoral collective bargaining agreements of the joint committee to which the employer belongs. This obligation does not apply to employers who employ fewer than 10 employees.

How much is the discount?

The amount of the discount depends on the extent to which the company was affected by the corona crisis. 'Heavily affected employers' enjoy a discount of up to 2,400 EUR per employee in the third quarter. All other employers are entitled to an exemption of 1,000 EUR per employee in the third quarter.

Only those employers whose employment was 50% lower during the first quarter of 2021 than in the first quarter of 2020, or 50% lower during the fourth quarter of 2020 than in the fourth quarter of 2019, are considered "severely affected.

Finally, the granting of the rebate is capped at the first 5 employees per unit of establishment from the employer.

2. Sectoral target group reductions

The travel industry

Companies registered in the CBE whose main activity is "travel agency" or "tour operator" can apply for an exemption from the patronal social security contributions for the second and third quarters of 2021, and this for all employees.

The event sector

Companies belonging to the events sector or to Joint Committee 304 can also apply for an exemption from the employer social security contributions for the second and third quarters of 2021, limited to 5 employees per employer.

The hotel industry

Companies whose main activity consists of operating a hotel or providing accommodation and fall under Joint Committee 302 can benefit from a target group reduction for the second quarter of 2021. The NSSO reduction consists of an exemption from the employer's NSSO contributions for the second quarter for the first 5 employees per establishment unit of the employer.

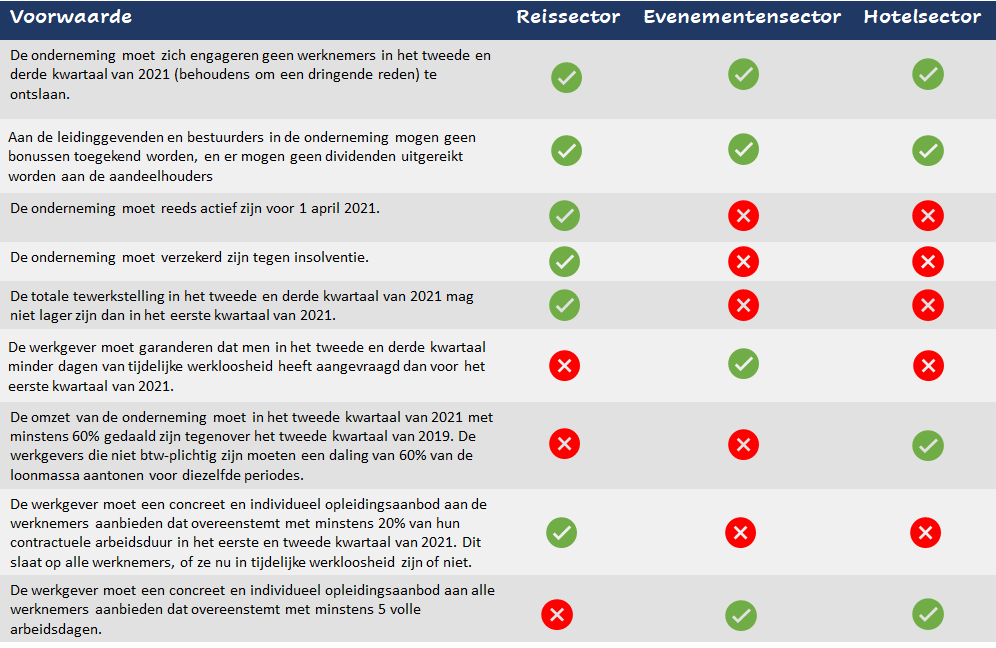

To be entitled to the target group reduction, the above sectors must also meet the following conditions:

If you want to know whether you, as an entrepreneur, are eligible for this target group reduction, please HERE Contact our social law expert.