Illness during annual leave: novelties as of 2024

In light of European law, since Jan. 1, 2024, there have been some significant adjustments to Belgian regulations on annual leave. If an employee falls ill prior to or during his vacation, these days will always be considered as sick days. The employee will receive guaranteed pay for the sick days and will be entitled [...]

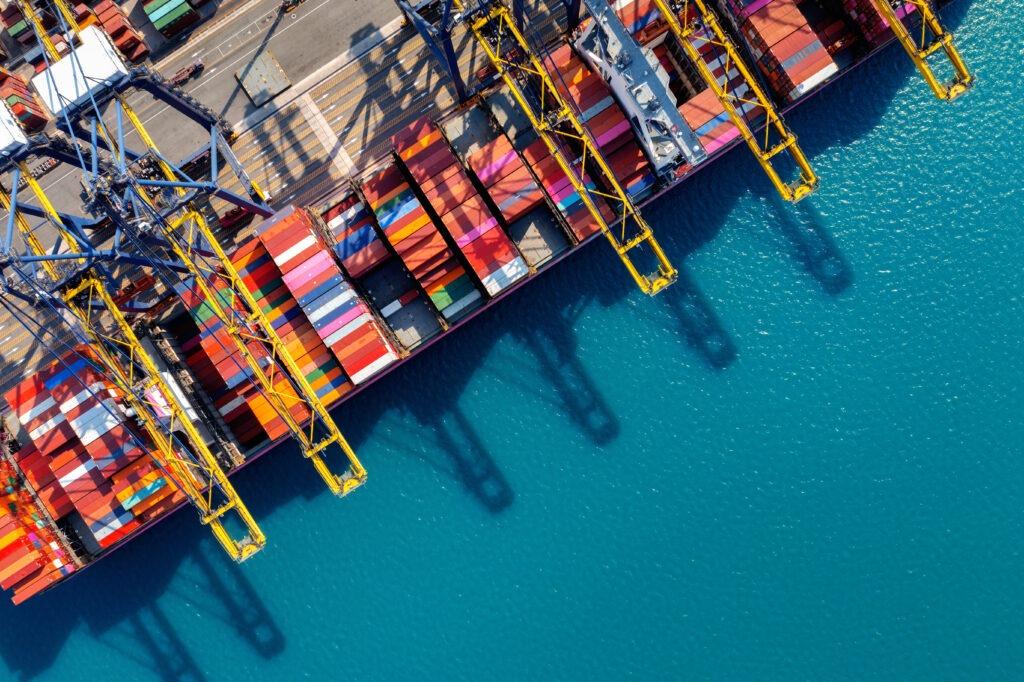

Want to know more about the Carbon Border Adjustment Mechanism (CBAM)?

How are CO2 emissions measured, are there exceptions to this measure, and what is the EU ETS? How are CO2 emissions measured under CBAM reporting? Until July 31, 2024, there are 2 options to measure CO2 emissions: (1) One of two possible "EU methods": The calculation-based method where [...]

What should you know about the Carbon Border Adjustment Mechanism (CBAM)?

What is the Carbon Border Adjustment Mechanism (CBAM), why was it created and what action is now required of you as a business owner? Introduced on October 1, 2023, the Carbon Border Adjustment Mechanism aims to assign equal carbon prices to goods produced within the EU and goods imported from [...]

To flexi or not to flexi: What innovations will 2024 bring in terms of the flexi job statute?

With the budget agreement for 2024, the government intended to make some adjustments within the widely known system of flexi-jobs. Indeed, the flexi-job statute offers the opportunity for certain employees as well as pensioners to earn a little extra on favorable terms and in a (fiscally) advantageous manner. At the end of 2023, the intentions of the [...]

Electrifying your fleet in 2024: the 4 most common charging questions

The recently changed tax landscape for company cars is causing more and more business owners to make the transition to an electric fleet. However, this transition is not limited to the process of choosing suitable cars. Charging the electric cars also involves a number of choices and investments. In this article, we provide the [...]

Commercial vehicles in 2024: everyone electric?

Since 01/07/2023, the taxation of the Belgian company car has changed radically. The federal government is fully committed to the greening of the Belgian car fleet. Is the electrification of your fleet really the only option or are fuel cars still worth considering? 1 The current tax rules for company cars Before getting into [...]

New fiscal-social rules set for 2024 - no major reform

In the summer of 2022, Minister Van Peteghem proposed a major tax reform. Because of the political landscape, this did not receive sufficient support and the presumption is that it will have to be pushed further by the next government. Despite this, a number of new laws were traditionally voted [...] in the last week of December.

Check the withholding obligation first, then pay on the new account number!

Laat je als ondernemer werken in onroerende staat uitvoeren (bouwactiviteiten, elektriciteitswerken, schoonmaak…) of doe je een beroep op een (onder)aannemer die actief is in de vlees- of bewakingssector, dan dien je bij iedere factuur die je ontvangt na te gaan of jouw contractspartij fiscale en/of sociale schulden heeft. Doe je dit niet, dan riskeer je […]

Are you aware: Whistleblowers and confidants in 50+ workers?

Voor ondernemingen met meer dan 50 werknemers staan er deze maand twee grote veranderingen op de planning. Zo is het sinds 1 december 2023 verplicht om een vertrouwenspersoon binnen jouw onderneming aan te stellen. Verder zal je als werkgever tegen 17 december 2023 ook maatregelen moeten treffen in het kader van de nieuwe “klokkenluidersreglementering”. […]

Employ fewer than 6 employees? Enjoy the target group reduction for first-time hires while you still can!

Vanaf 1 januari 2024 staan er – in het kader van de begrotingscontrole – verdere besparingen op het programma met betrekking tot de zgn. “doelgroepvermindering voor eerste aanwervingen”. Deze doelgroepvermindering maakte het tot voor kort mogelijk om als nieuwe werkgever voor jouw eerste zes aanwervingen een mooie “RSZ-korting” te genieten. Vanaf 1 januari 2024 […]