What is Euribor?

Euribor is an abbreviation of Euro Interbank Offered Rate and is a variable interest rate at which banks in the Eurozone lend money to each other. The Euribor is published daily for different maturities between 1 week and 12 months.

The Euribor rates are also often used by European banks as the base rate for all kinds of other interest rate products, such as a straight loan, revolving loans, factoring agreements,...

In most cases the interest in these contracts is determined by increasing the Euribor with a commercial margin (usually between 1% and 2%). If this Euribor is lower than 0, then it is considered to be equal to 0 (= 'floated'). The total interest rate cannot then be lower than the margin.

Evolution of the Euribor?

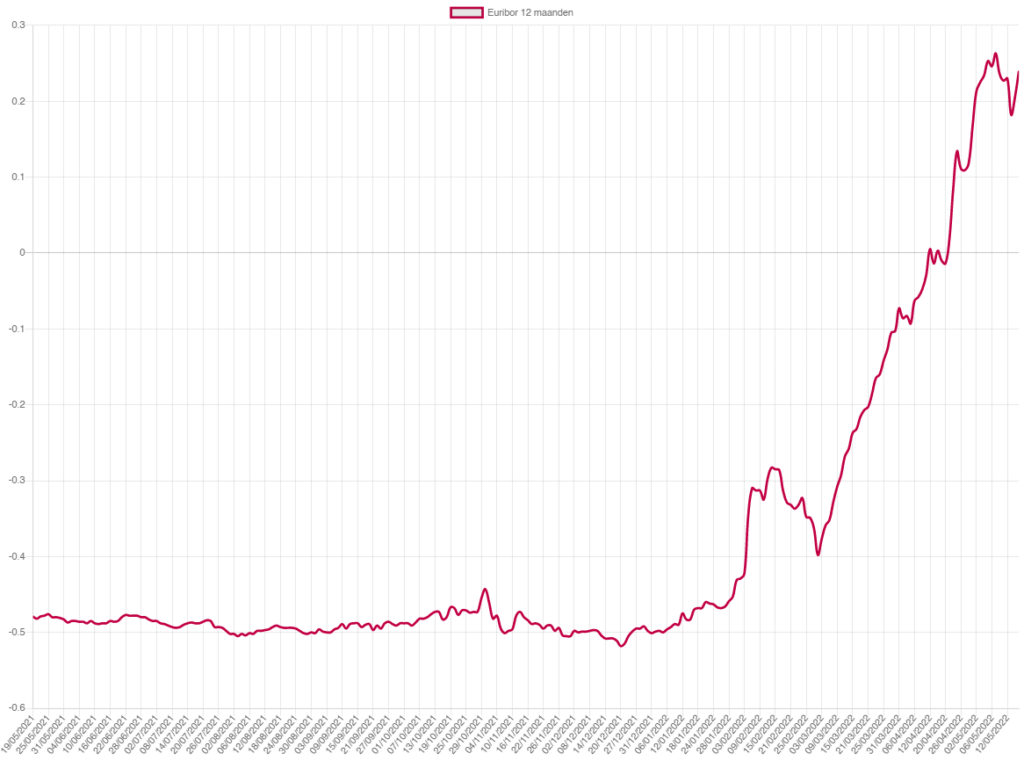

Over the past 6 years the Euribor has been consistently lower than 0. At the end of 2021 it still had a value of -0.50% at a maturity of 12 months. Since January 2022 this graph has been on an upward trend. However, for most companies this increase had little impact as the Euribor in most contracts is considered to be at least 0%.

In mid-April, the 12-month Euribor exceeded the 0% mark and the first positive amounts were measured. Meanwhile, the interest rate continued to rise and today stands at about 0.25%. The Euribor interest rates on shorter maturities remain negative for the time being.

What is the impact for your business?

Credits with short-term interest rates become more expensive.

A 12-month draw on a straight loan currently costs 0.25% more than the margin consistently paid in recent years.

It is certainly possible that this upward trend will continue for a while. Especially since the ECB announced last week that they will continue to tighten monetary policy.

How can I protect my business from the consequences?

There are products on the financial market that protect companies against an increase in the Euribor interest rate. Is it about a loan with a long duration? Then the interest rate can be changed from a variable to a fixed rate via an interest rate swap contract ('IRS'). For contracts without an end date (indefinite duration) it is more difficult. There are products on the financial market that hedge the interest rate for a certain amount and a certain term, such as 'CAPS'.

The price of this is highly dependent on market conditions and is best coordinated with your contact person within the bank. Of course we can look at the possible options together with you.

Do not hesitate to contact us here contact us with questions.

Would you like a conversation about the right approach for your business? Then make an appointment here with our pro experts!