TITECA PRO EXPERTS

Pro guidance on succession planning

Frequently Asked Questions

Concluding a marriage contract is certainly not an obligation, but it is important that you inform yourself well about the consequences of whether or not you have concluded a marriage contract. In the absence of a marriage contract, you will automatically be subject to the rules of the legal system as regulated by the Civil Code. It is therefore important to know in advance exactly what these rules entail.

By drawing up a marriage contract you can change some of the rules that you feel less comfortable with and you can tailor the way in which your assets are arranged for the duration of the marriage. So be sure to get advice before you get married so that you know what the consequences of the (chosen) system are.

Regardless of the system under which you are married, it is always a good idea to review at periodic intervals whether the choices made when you entered into the marriage still meet your current needs and desires.

Not only may your personal situation have changed over the years, but also the state of the law - not only civil, but certainly fiscal - may have changed, so that it is quite possible that the current situation no longer matches your goals as partners. For this reason it is always advisable to have a screening of your current situation from time to time and to make adjustments if necessary.

There are various ways of incorporating protection mechanisms between spouses. Gifts, wills, but also clauses in a marriage contract, such as an option clause, can offer an adequate solution.

Each choice has its own advantages and disadvantages on a civil and fiscal level, so it is very important to first map out what goals and wishes you and your partner want to pursue. Once this is clear, a specialized tailor-made solution can be worked out, possibly combining different techniques.

In the event of your death, the composition of your estate will be examined on the basis of your matrimonial property regime and, if applicable, your marriage contract. In the absence of any other arrangement, this inheritance will then accrue to your legal heirs on the basis of the rules of the Civil Code.

On the tax side, your heirs will be taxed in the inheritance tax. This is calculated in instalments using rates that increase as the value of the assets in your estate also increases. To give an example, for your partner and children the highest rate of inheritance tax is no less than 27%. In order to concretely map out the impact of a death, your personal situation must first be mapped out in detail, after which, if necessary, various possible tailor-made solutions can be worked out.

If you wish to transfer assets during your lifetime, you can do so by making a donation. Except between spouses, a donation must always be irrevocable and the donor may not have the possibility of unilaterally reversing it, except in very exceptional cases. There are, however, ways of accommodating this and providing a certain protection for yourself as a donor.

A first possibility is to build in certain financial securities as a donor. For example, by donating with the proviso of usufruct, the donor can still enjoy the income and fruits of the gift. Another possibility is that the gift is made under a burden of annuity, whereby the donee is obliged to periodically, e.g. monthly, pay a certain amount to the donor. There are also structures that allow you, as the donor, to make arrangements but still keep an eye on the prudent management of the donated assets. Every donation deserves personal and tailor-made advice as everyone's needs and wishes are different. So be sure to seek proper advice from a specialist in the field before actually proceeding to make a donation.

As an ex-partner, the parent of your children has no claim to your inheritance; it goes entirely to your children, unless otherwise agreed. If your children are still minors, that parent has the parental management and the parental right of usufruct over the goods of the minor.

If you want to avoid this, several solutions can be worked out, ranging from drafting a will to working out certain control structures.

If you reject your parents' estate, your children will come to your parents' estate in your place and receive your inheritance directly. If you want to avoid this, the estate must be rejected in the name of your children. The rejection of an inheritance is an act that you as a parent cannot perform in the name of your minor children. For this you need the permission of the Justice of the Peace.

In order to obtain this permission, you will have to be able to prove that the rejection is in the interest of the children, e.g. because the estate is in deficit, otherwise a justice of the peace will not give permission.

If you can no longer perform any actions yourself with regard to your assets, an administrator must be appointed. For this purpose, your relatives must apply to the Justice of the Peace with the request to appoint an administrator. In this case it is the Justice of the Peace who decides (i) who will be appointed as administrator and (ii) what powers this administrator will have.

By means of a power of attorney, however, you can avoid your relatives having to go to the Justice of the Peace for this. In a power of attorney, you not only determine yourself who you appoint as trustee(s), what powers you assign to the trustee(s), etc., but you can also prescribe by whom and how it is determined that you are indeed incapable of managing your assets yourself. With a power of attorney you therefore not only avoid the administrative hassle of a legal procedure for your relatives, but you also retain full control over the way in which the management of your assets will take place.

The Titeca Pro Expert:

your confidant

At succession planning is not only knowledge important, but also experience. Naturally, our Pro Experts about both. But there is more.

We not only pay attention to the numbers, but also to the person(s) behind the story. That involvement translates into our personal, proactive, professional and productive approach.

Discuss your questions with one of our experts.

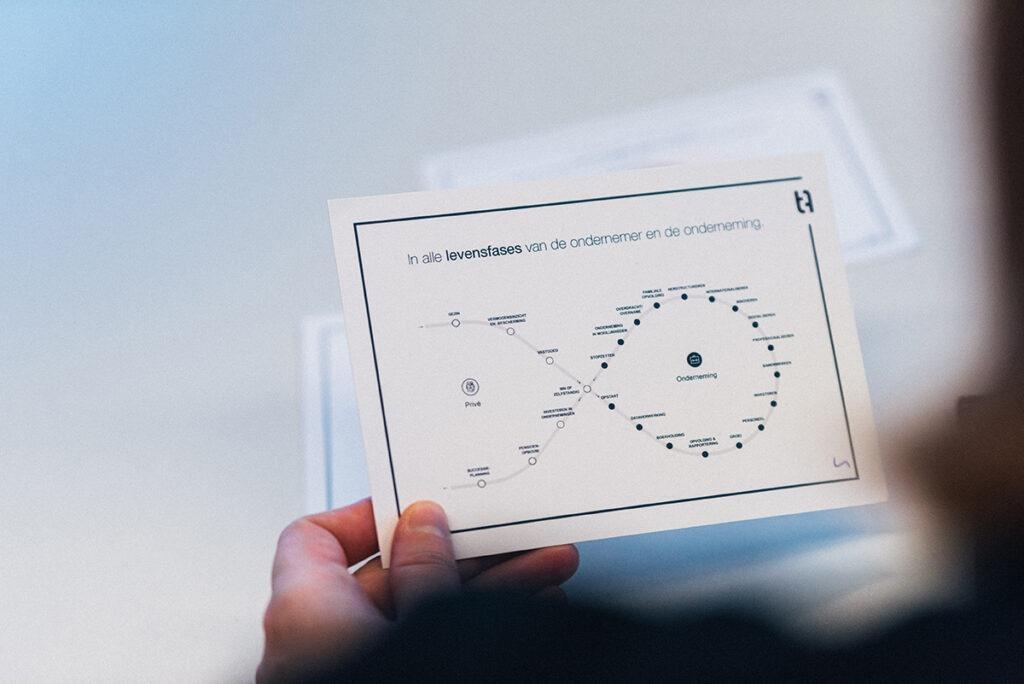

A pro by your side at every stage of entrepreneurship!

For every question or challenge you face as an entrepreneur, there is a Titeca pro accountant or expert by your side, who with the right knowledge and experience and proactive, professional and productive attitude, can offer a tailored solution.

News and stories from this phase of life

In the meantime, discover our other stories or news items!