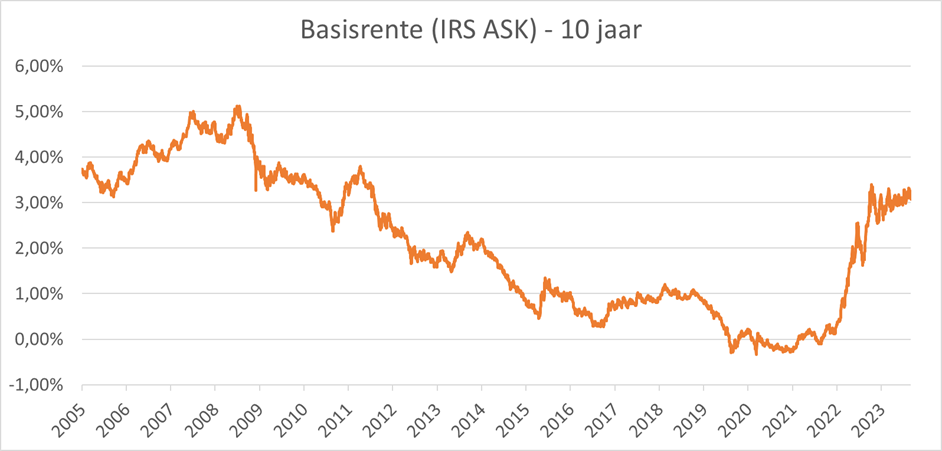

Interest rates have been rising. After a period when they were historically low, there was a marked rise in recent months. Although current interest rates are still low compared to levels before and during the financial crisis, the cost of interest rates today is no longer negligible. Increased interest rates should be taken into account when making investment and other decisions, such as stock construction. These decisions may also affect your company's broader cash policy. We offer 5 tips to protect your company from this.

Consider investments

Rising interest rates mean initially, of course, that borrow more expensive becomes. Which can logically impact certain investment decisions by altering their returns. Therefore, think carefully about investments. Are planned investments necessary or rather nice-to-have? Do we need to replace quickly or can certain items last another year? Determine what form of financing will be most beneficial: a traditional loan, a lease or even just equity?

When taking out an investment loan, two things are crucial: the type of interest rate (fixed or variable) and the term. A longer term has the advantage of lower periodic repayments, which may be desirable at higher general interest rates. Typically, however, this also means that the total interest expense is higher than if a shorter term is opted for. A variable interest rate is under normal circumstances lower than a fixed interest rate at the time the loan is taken out, but naturally carries the risk of rising as market interest rates increase.

Today, however, the market assumes we are in a situation that can be considered an interest rate peak. As a result, variable interest rates are currently above fixed interest rates. So it seems logical here to always opt for a fixed interest rate, however, if market interest rates were to fall, this means that one will not be able to enjoy the fall in interest rates as a result.

Optimize your working capital

Another important concern regarding the broader cash policy is the optimization of the working capital. Inventories and outstanding receivables consume cash, while supplier payables provide additional resources. The longer the payment period that you can obtain at your lesuppliers, how more cash you can keep in the enterprise. Make sure the inventory is appropriate for the business activities, as overstocking is easy for day-to-day operations, but these also absorb cash. Optimizing inventory management ensures so for that there are additional funds available that can be used elsewhere or that there is a lower funding requirement. Improve also the payment behavior of your customers; even shortening payment terms can improve liquidity.

Get smart about your financing

Optimization can also be done by smart to deal with With the use of certain types funding. Go after as the funding for prepayment, year-end bonuses, vacation pay, and so on cash is needed. The cost, unlike previous years, is no longer negligible. Also When recording a straight loan (type of credit that you can use for short-term tical financing needs) Should the increased interest cost to be taken into account. Do not do recordings when the cash itself is available. Hou also take into account the term of the withdrawal. The longer the term, the higher the interest rate. Do not make withdrawals longer than necessary.

Go for a higher return on your cash

The Putting excess cash to work offers an opportunity for further optimization from the cash policy. During certain periods through the year has your company possibly have more than sufficient funds. Savings accounts to date still offer little protection against the current inflation (4.09% in August). A more profitable banking product which is currently gaining popularity to these temporary cash surpluses to accommodate is the term account. In term accounts, funds are held during a predetermined term (ranging from one month to one year, or even several years) and against a fixed interest rate lodged with the bank. Interest received depends on maturity and amount awarded, but offers to date thus a higher returns and better protection against inflation than traditional savings accounts. Details regarding the prevailing rates and other investment products can be obtained from your banker.

Engage in cash pooling

If your company is from multiple companies exists then setting up a cash pooling possibly also provide a solution to fine-tune your cash policy. In cash pooling, the funds of multiple subsidiaries or operating companies centralized and housed in one company. In dhe holding company or the parent company all funds are brought together for the purpose of cash flow management at centralize and balance the bank accounts of all subsidiaries. Cash pooling ensures that your liquidity can be put to optimal use and that credit costs are limited. As own resources are optimally utilized, the need for external financing thus decreases.