Find the latest update (19/03/2024) here.

The reprobel declaration. A term that may not sound familiar to many entrepreneurs, but then suddenly the declaration arrives in the mail. What exactly do you have to do with this declaration, what steps do you have to take and above all, do you have to pay anything? We would like to give you an overview of the to do's.

Reprobel declaration in practice

Reprobel is the body responsible for the collection of reproduction remunerations, in other words remunerations for making prints and photocopies, digital or otherwise, of copyright protected works for internal use. The goal of Reprobel is in fact the same as that of SABAM, namely to collect copyrights and redistribute them among the authors. However, this concerns writings (books, articles, etc.) and not music. Important is that in principle every entrepreneur is obliged to submit an annual declaration.

When to file a tax return?

It is only possible to file a declaration when you have received an email or letter from Reprobel itself. This letter or mail will contain a username and password. This will also contain include the deadline by which you must file the return at the latest. Most returns must be filed at the course of April-May 2023. Important, anyone who has received a communication from Reprobel will action need to undertake. Did you take prints or photocopies then the declaration must be completed and you pay the fee. If you did not take photocopies during the reference year you will be charged a nula declarationtiredtand submit.

If a letter or mail was received and no return is filed or it is filed late, a fine may be imposed. If no communication was received, filing a declaration is not possible. Of course, you can always make a spontaneous declaration and contact Reprobel for this purpose.

How to file a tax return?

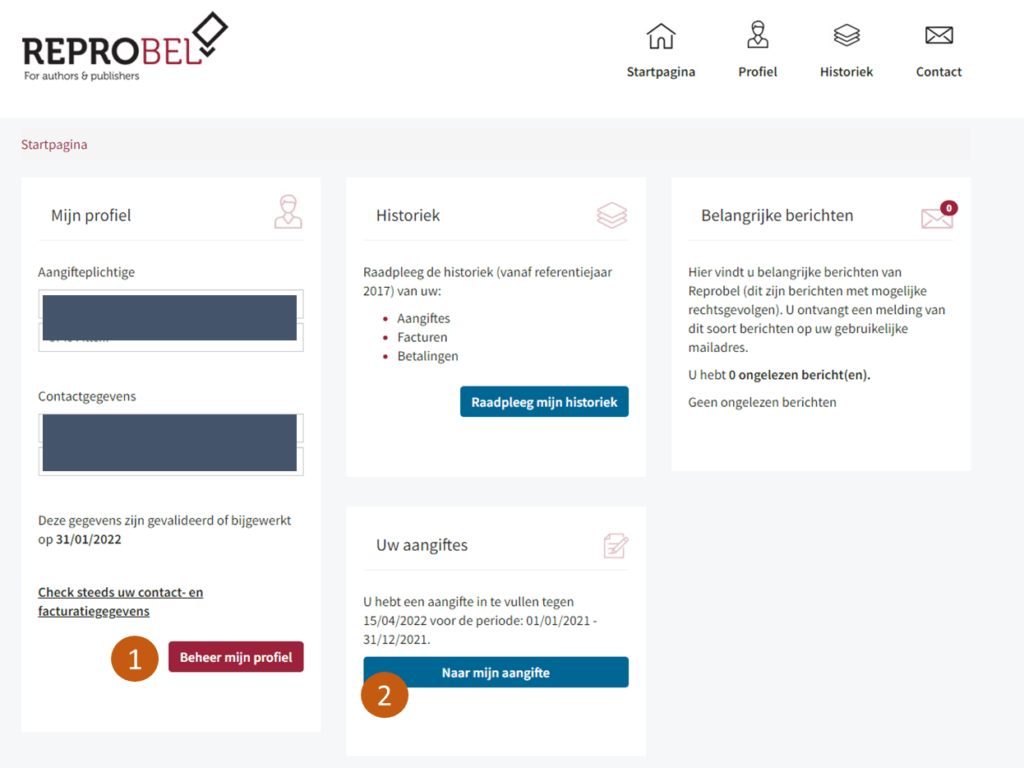

STEP 1: Log on to the online portal of Reprobel: https://portal.reprobel.be/portal/

STEP 2: Check and complete your billing information under "My Profile" using the "Manage My Profile" button.

It is important to check the Nacebel code. After all, it is important later for the declaration and price of any license.

Here you can also indicate if you have a paper press review or documentation center.

- Press review: a summary systematically prepared and distributed internally to employees, consisting of photocopies and/or prints in various copies of extracts from newspapers, weekly newspapers and magazines.

- Documentation Center: A place in your company where information is made centrally available (for consultation, loan or further internal dissemination) for the benefit of a group of employees or other users.

Both terms have an impact on the cost of the license/declaration.

STEP 3: Start the declaration via the "Go to my declaration" button.

STEP 3a: First, you will be asked to communicate the number of employees. Normally, the category you belong to is automatically filled in correctly based on the Nacebel code checked earlier. The different categories are:

- (I) Anyone not covered by II or III.

- (II) Mixed activities: in addition to the mere provision of services or supply of goods, also intellectual services e.g. accountants, architects, engineers, consultants, etc.

- (III) Purely intellectual services: e.g. lawyers, notaries, etc.

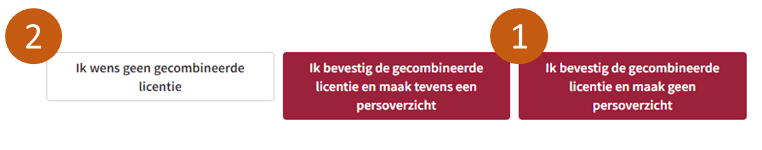

STEP 3b: Now you can choose between the following options:

- Either choose the license that Reprobel proposes. (1)

- Either choose the per-copy/print reimbursement scheme or per relevant employee. (2)

The license is more expensive than the fee per copy, but it also offers advantages.It allows protected works to be reproduced digitally, which is not allowed with the remuneration per copy.The risk of control is therefore much smaller, as is the risk of fines and/or tariff increases. A tariff increase is be imposed per page.It also simplifies administration. There is no need to keep track of how many copies were taken.

The cost of the combined license can be found at the website of Reprobel. This varies and is depending on the number of relevant employees.Relevant employees are those who can take photocopies or prints. For example, a warehouse worker or truck driver may qualify as a non-relevant employee.

If you have a nula declaration wishes to file then do not choose the combined license. Then in the following steps you can file a flat tax return per employee or per copy.

Do you have any questions about this or would you like assistance in filing this return? Then contact us here or make an appointment.