At the beginning of 2022 many entrepreneurs got acquainted for the first time with Reprobel, the body responsible for the collection and redistribution of reproduction remunerations. This year again many entrepreneurs received a letter or e-mail asking them to submit their declaration before the deadline of 30/04/2024. All the more reason to reiterate exactly what Reprobel entails and what steps you need to take. Below we would like to give you an overview of the to do's.

What does Reprobel do?

Reprobel is the body responsible for the collection of reproduction remunerations, in other words remunerations for making prints and photocopies, digital or otherwise, of copyright protected works for internal use. The goal of Reprobel is in fact the same as that of SABAM, namely to collect copyrights and redistribute them among the authors. However, this concerns writings (books, articles...) and not music.

Consider, for example, making a copy of a page in a book, using an image from the Internet in a presentation, or sharing an article on the internal company network. If you do not pay a reproduction fee for this, you are basically violating copyright.

Can Reprobel also do something for you?

Of course, as an author or publisher you can also claim the reproduction remuneration that Reprobel receives and redistributes if you create copyright-protected works yourself. You can do this by joining a member-management company of Reprobel, such as SACD, Copiebel, etc.

What is expected of the entrepreneur now?

Any business owner who received a letter or email is mandatory file a return. The deadline for this is April 30, 2024. Via the username and password in the letter or e-mail you can log on to the portal and complete the declaration. If you have been notified by Reprobel, action must be taken anyway. If you have not taken any photocopies during the reference year 2023, you will be able to file a zero declaration. If you have taken digital or paper prints of copyright protected works, then you can opt for a declaration based on the number of copies or for the combined license.

It is important to note that if no letter has been received, filing a declaration is not possible. You can of course always file a declaration spontaneously and contact Reprobel for this purpose.

Did you not respond to the letters or emails you received in previous years? Don't panic! You can still file a return for previous years. We strongly recommend doing so to avoid penalties.

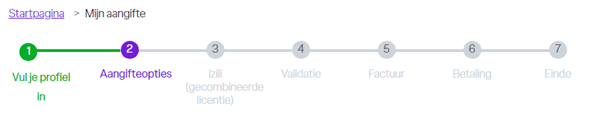

How to file the Reprobel declaration?

Log in to the online portal of Reprobel.

STEP 1: Check your billing information and complete it in step 1 or via "My Profile".

Note: It is important to check the Nacebel code. After all, it is important later for the declaration and the price of any license.

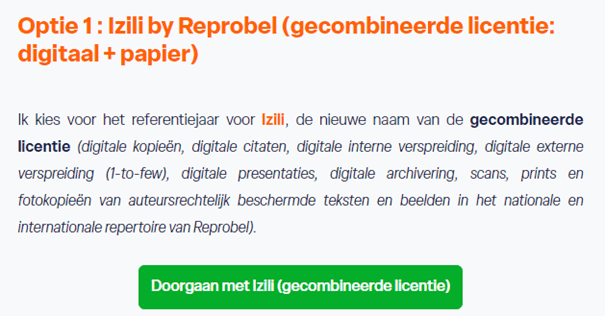

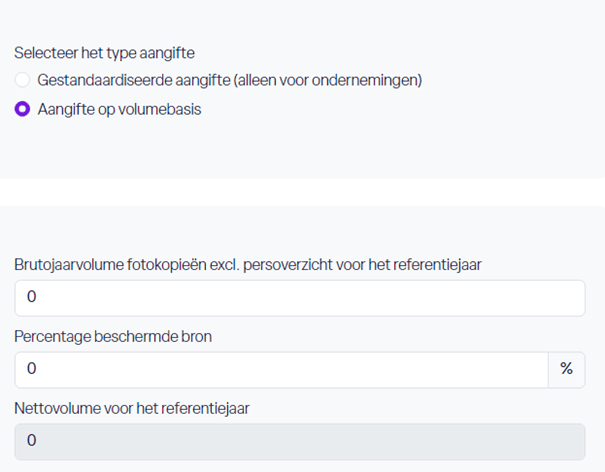

STEP 2: In a second you either choose to file a reprography declaration or choose the combined license. Option 1, the combined license, which has been called "Izili" since this year, can be compared to a flat-rate tax return. A fixed price is charged, regardless of the number of copies or reproductions, whether digital or on paper. The price of the license depends on your business activity (via your Nacebel code) and the number of relevant staff members and not on the number of copies taken. A relevant staff member is someone who takes copies (digital or paper) of copyrighted works on a regular basis. For example, consider someone who writes the newsletter within the company. In contrast, a warehouse worker or truck driver, for example, may qualify as a non-relevant employee.

License fees range from 40 EUR (category 1, without staff) to 29 EUR base fee increased by 29 EUR per additional relevant staff member. More detail on pricing can be found at the site itself.

The license is thus more expensive than the per-copy fee, but it also offers advantages. It allows protected works to be reproduced digitally, which is not allowed with the remuneration per copy. The risk of inspection is thus much smaller, as is the risk of fines and/or rate increases. A rate increase is imposed per page. This also simplifies administration. There is no need to keep track of how many copies have been taken.

Wish you a nihila declaration submit, then you can choose option 2.

STEP 3: Depending on the choice you made in step 2, you will either have to provide additional information about the company's activity and the number of relevant personnel or communicate the number of prints on paper.

STEP 4: Finally, depending on the data entered, you will be shown a summary of the declaration, as well as the question to confirm it and make any payment due.

Do not hesitate to contact us here contact us with questions.

Many answers can also already be found in the FAQ of Reprobel itself.

Unsure of the right approach for your business? Then make an appointment here with our pro experts!