In the spring, the federal government reached an agreement on a mini-tax shift, one of the chalk marks of which was the lowering of wage costs. In addition to an expansion of the work bonus and the revision of the special contribution to social security, the system of exemption from paying payroll tax is also being reformed. Among other things, the regime for shift and night work is being tightened.

In our opinion, the perfect moment to put this regime once again in the spotlight. Making use of this exemption can lead to significant savings in salary costs for the employer. In this article we explain, in addition to the changes made, what the conditions are and what exactly the benefit consists of.

Exemption from withholding tax on professional income

Withholding tax is a mandatory deduction that you, as an employer, must make from your employee's gross salary and is actually an advance on the personal income tax owed by the employee. In some cases, a reduction of the withholding tax is granted in favor of the employee. In this case, the who thus retains more net pay. In addition, there are situations where you as an employer are exempted from paying the payroll withholding tax. This means that the employer can keep the part that does not have to be paid on and therefore reduces the wage costs.

Today, there are different regimes regarding the exemption from paying payroll withholding tax in favor of the employer, each with its own conditions. The most commonly used exemptions are those for overtime worked, for research and development and for shift and night work.

With the mini-tax shift, the scope of each of these regimes was further defined, effective from 01/04/2022. It is thus stipulated that certain regimes can be cumulated or not, and an extensive declaration obligation is introduced for various regimes. For shift and night work, for example, the basis for calculation and the amount exempted under this regime must be recorded for each employee.

In this article, we zoom in on the shift and night work exemption.

Do I qualify as an employer?

If your employees are required to work in shifts or at night, as an employer you are obliged to pay them a shift premium. As a compensation, as an employer you can benefit from an exemption from paying payroll withholding tax of 22.8% if the following conditions are met:

| Shift work regime: | Night work regime: |

|

|

(*) Change only takes effect for premiums granted as of 01/04/2024.

If there is night work involving shift work, only one exemption can be enjoyed. A cumulation of regimes is not allowed. However, the exemption for shift or night premiums can be combined with the exemption for fiscally beneficial overtime.

Example

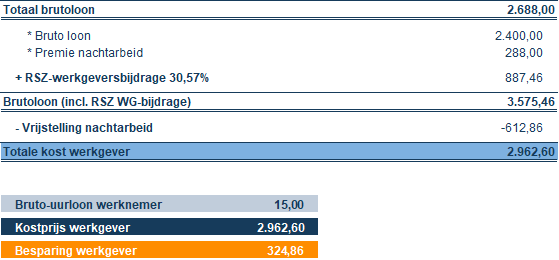

Jan Janssens, night worker, has a basic gross hourly wage of EUR 15. On top of this he is entitled to a night bonus of 12%. According to his employment contract, he is required to work 38 hours per week.

The employer's wage cost increases by EUR 288 per month due to the mandatory granting of a night bonus. However, as a result of this, an exemption from the payment on account can be enjoyed of EUR 613. In total, the cost saving for the employer is therefore approximately EUR 325 per month. The employee thus receives EUR 288 more gross, while the cost to the employer falls.

Practicality?

Applying the exemption for shift work and night work can therefore result in considerable savings as an employer. If you meet the conditions, be sure to contact your social secretariat, they will be happy to help you with the practical formalities.

Do not hesitate to contact us here contact us with questions.

Do you wish to check whether you qualify for other regimes of exemption to pass-through withholding tax? Then schedule an appointment with our pro experts here!