What is the CBAM (Carbon Border Adjustment Mechanism), why was it created and what action is now required of you as a business owner?

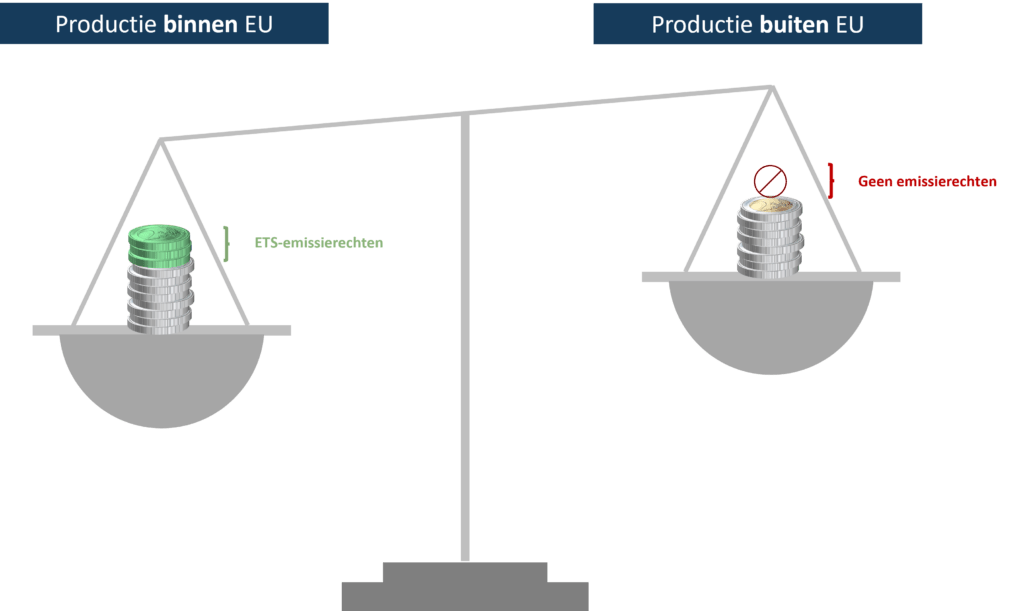

Introduced on Oct. 1, 2023, the Carbon Border Adjustment Mechanism aims to assign equal carbon prices to goods produced within the EU and goods imported from outside the EU. In doing so, the CBAM aims to minimize so-called carbon leakage. Carbon leakage occurs when companies transfer production to countries with less stringent climate regulations to save costs, undermining Europe's efforts to curb CO2 emissions.

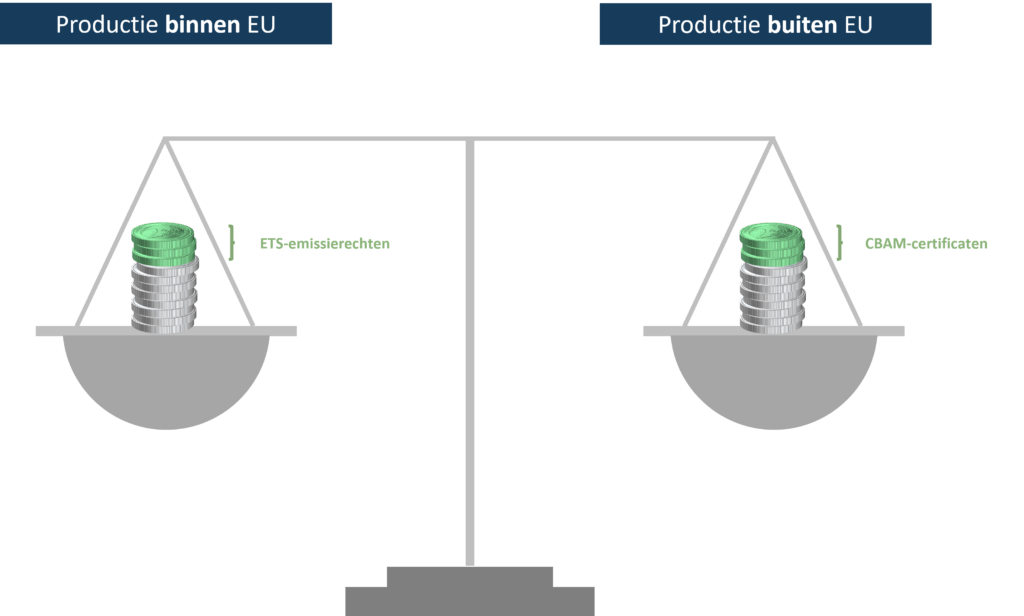

With the introduction of the Carbon Border Adjustment Mechanism, an importer will pay a levy on imports of certain goods from outside the EU that is equivalent to the levy on domestic industries through the EU Emissions Trading System (EU ETS). Specifically, this eliminates competitive advantages due to less strict compliance with climate standards, allowing for a renewed stronger commitment to climate.

Imbalance between production cost inside and outside EU

(situation for introduction CBAM)

Balance between production cost inside and outside EU

(situation after introduction CBAM)

How did the CBAM come about?

As part of sustainability efforts, Europe has set itself the goal of reducing its CO2 emissions by at least 55% by 2030 compared to the base year of 1990. The overarching package created for this purpose is the so-called "fit for 55" package. This package aims to reform a series of European laws to better align European policies with climate goals. The Carbon Border Adjustment Mechanism is one of the pillars of the fit for 55 package that will contribute to these climate goals.

Phased implementation of Carbon Border Adjustment Mechanism.

PHASE 1 : Transition period - From October 1, 2023 to December 31, 2025.

What

The Carbon Border Adjustment Mechanism is in place during this two-year transition period, but there are no financial implications yet linked to it. Consequently, no CBAM certificates have yet to be purchased. The main objective of this transition period is to prepare companies by 2026.

When to report

Quarterly, by the end of the month following this quarter (e.g., Q1 2024: April 30, 2024).

PHASE 2: Full rollout of CBAM - As of Jan. 1, 2026

What

CBAM certificates must be purchased, with 1 certificate being equivalent to the emission of 1 ton of CO2. The price for these CBAM certificates is based on a market price of ETS allowances and aims to provide a level playing field create between European and non-European imports.

When to report

Annually on May 31 of the year following this year (e.g., 2026: May 31, 2027).

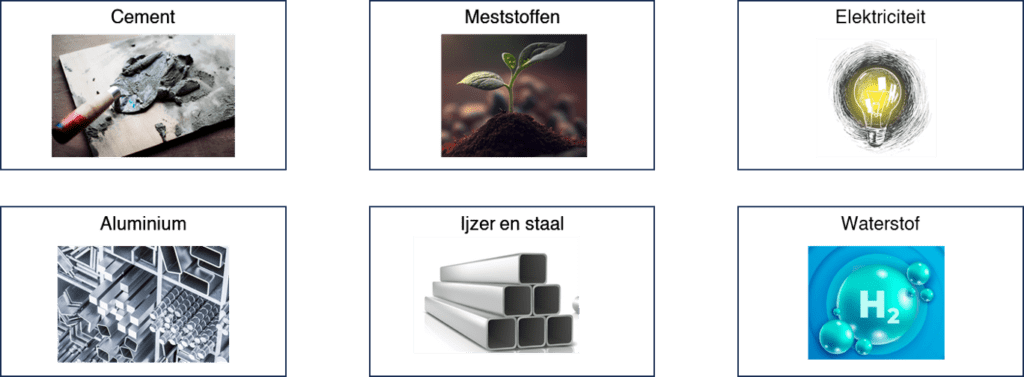

To which sectors does the CBAM apply?

Europe decided to initially introduce CBAM on 6 sectors whose production is very carbon-intensive is. The approach here is to focus on commodities and raw materials, not on goods containing a small amount of the products listed below.

Europe argues first that the goods covered by the CBAM system are expanded by 2030 will be with the sectors included in the EU ETS.

How can your company prepare for the Carbon Border Adjustment Mechanism?

- Rate the impact that CBAM has on you by checking whether you import goods for which a CBAM declaration needs to be made

- Register your on the platform for the CBAM registry to upload you CBAM reports

- Communicate with your non-European trading partners regarding CBAM obligations and the information they must provide to you for this purpose

- Submit your CBAM report through the CBAM registry based on the information received from your supplier

Are you like us all the way pro sustainability And would you like to know more about CBAM? Then read our extension here!

Do not hesitate to contact us here contact us with questions.

Would you like to proactively address this issue so that you too can make an impact to create a more sustainable world? Then make an appointment here with our pro experts!