Flanders - 4th quarter 2022

Companies with an operating loss in the fourth quarter of 2022 are eligible for energy support from the Flemish government provided they meet a number of strict conditions. Energy-intensive enterprises can count on increased support. It is expected to be repeated for the first quarter of 2023.

How much is the support?

- The standard support is 25% of the energy surplus cost of the fourth quarter of 2022, limited to 80% of the operating loss and up to EUR 500,000.

- For energy-intensive companies*, the support is 30%, limited to 80% of operating loss and up to a maximum of EUR 4,000,000.

- Energy-intensive enterprises operating in one or more particularly affected sectors, as defined in the European Temporary Crisis Framework**, receive 35 %, limited to 80% of operating loss and up to a maximum of EUR 7,500,000.

The eligible energy incremental cost is calculated as the product of, on the one hand, the difference between the unit price paid by the company as a final consumer with an external supplier during the fourth quarter of 2022 and twice the average unit price paid by the company as a final consumer with an external supplier for energy expenses in 2021, and, on the other hand, the volume consumed for this energy during the fourth quarter of 2022.

Eligible additional cost will be calculated per month in accordance with monthly billing.

In application of Europe's temporary crisis framework, the quantities of natural gas and electricity used to calculate the additional cost must not exceed 70% of consumption in the same month in 2021.

(*) Energy-intensive companies are those whose energy expenditures represented at least 3% of sales achieved during calendar year 2021, as inferred from the financial statements or income statement.

(**) These are the following sectors : production of metals, chemical and fertilizer subsectors, paper industry, textile industry, synthetic fibers and glass fibers, refineries, glass industry, manufacture of wood panels, manufacture of ceramic tiles and manufacture of mineral wool (insulation).

Who can call on the support?

Only those companies that meet all the conditions listed below are eligible for the aid:

- The company must have incurred at least EUR 7,500 (excluding VAT) in electricity and gas expenses at its Flemish sites by 2021.

- The company must incur an operating loss (negative EBITDA) in the fourth quarter of 2022. That loss must be attested by an approved external auditor, an approved auditor or a certified public accountant.

- The company may not pay dividends during the period from Oct. 1, 2022 to Dec. 31, 2023.

- A company with a NSSO employment of more than 10 people may not put more than 35% of its workforce on temporary unemployment during the fourth quarter 2022 due to increased energy costs.

- A company under the scope of an energy policy agreement must subscribe to it and comply with its terms.

For the increased support (30% or 35%) is subject to the additional condition that the additional cost must be at least 50% of operating loss. Energy-intensive companies that do not meet this requirement can well still fall back on the standard support.

Who will be excluded from this measure?

The following companies are expressly excluded from support:

- Companies in the legal state of dissolution, cessation, bankruptcy or liquidation;

- Companies that had negative equity in both fiscal year 2019 and fiscal year 2021;

- Companies that were not yet incorporated on Oct. 1, 2021;

- Credit and financial institutions;

In addition, there are a number of cumulation provisions. For example, energy support in 2023 is not cumulative with the Strategic Transformation Support Whether the SME growth grant.

When and how can you apply for the support ?

The application will be submitted online and further processed digitally. The online application is possible from Dec. 12, 2022 to Feb. 28, 2023, 12 p.m.

A company should submit a single application for the combined energy costs of all its establishments or industries.

Keep the following information handy:

- the total gas and electricity costs and consumption of the Flemish sites for 2021

- projected monthly costs and consumption of gas and electricity for the Flemish sites for the fourth quarter of 2022

- the company's expected operating loss for the fourth quarter of 2022.

- Your company's annual turnover for the 2021 calendar year (not required for self-employed)

Small consumers with annually read meters for gas or electricity can use the calculation module for calculating monthly consumption and costs. The use of this calculation module is optional.

After submitting the aid application, you will receive notification of the provisionally calculated aid by mail. Since the calculation is based on expected costs and consumption and an expected operating loss, this aid amount will be an estimate.

This does not yet take into account the maximum aid ceiling at group level nor the maximum budget for this aid measure. If the available budget is exceeded, the aid is paid pro rata to the beneficiary companies after application of aid rates and aid ceilings.

How do you apply for payment of energy support?

Only companies that have received a notification of calculated support (see above) can apply for payment of energy support. This is also done online.

Payment of aid can only be requested once the company has:

- 2021 gas and electricity energy bills

- gas and electricity energy bills for the fourth quarter of 2022

- the attestation of an external auditor, a company auditor or a certified public accountant approved by ITAA regarding the EBITDA of the fourth quarter of 2022. VLAIO will provide a template for this purpose.

- a filed financial statement covering the calendar year 2021 (not for self-employed persons)

- a bank certificate

After checking the disbursement application with accompanying supporting documents, the aid will be definitively calculated and disbursed. The definitively calculated aid may be higher or lower than the provisionally calculated aid (see initial application).

Flanders - 1st quarter 2023

It will also be possible to apply for Flemish energy support for the first quarter of 2023.

Adjustment

After an evaluation of the energy support for the fourth quarter 2022, the Flemish Government is adjusting the conditions for the first quarter of 2023 here and there :

- Any healthy company with at least €7,500 in electricity and natural gas spending at its Flemish sites in 2021 is eligible.

- Only price increases in electricity and natural gas that exceed 2021 prices by more than 50% can be subsidized.

- In addition, the company must experience a decrease in its gross profit (EBITDA) of at least 50% in the first quarter of 2023.

- Of the minimum gross profit decrease, the total additional cost of gas and electricity must be at least 70%, or 35% of the pre-crisis gross profit.

Other conditions remain unaffected. For example, any company receiving the aid:

- required to remain active in Flanders for at least five years;

- it may not pay dividends until the end of 2023;

- it must not have placed more than 35% of its personnel on temporary unemployment for the period for which it receives aid;

- and every company with high energy consumption must sign an energy policy agreement, committing itself to reducing its energy consumption, for example through process modifications or innovative renovations.

When to apply.

The regulations for this support period are being further developed and will then be submitted to the European Commission for approval.

GREEN investment support

VLAIO's GREEN support focuses on companies making investments to make the transition from fossil fuels to electricity or green energy (greening theme) and/or reduce their overall energy consumption (energy efficiency theme)

The following investments are not eligible:

- investments included in the limitative technology list of ecology premium+. These investments must be submitted through ecology premium+.

- investments to meet legal obligations (e.g. related to standards to be met, environmental permits, energy policy agreements and sector federation agreements, etc.).

Greening theme

We speak of "greening" when the end user replaces fossil fuels (such as natural gas, diesel, heating oil, etc.) with green heat, green cold, electricity, green hydrogen, blue hydrogen, residual heat or residual cold.

Following green energy carriers are supported in this call :

Heat:

- Derived from solar thermal energy (not solar photovoltaic (PV) panels), geothermal, water or soil (not air), biomass meeting sustainability criteria, from RED II, gas from sewage treatment plants and biogas;

- Green hydrogen: produced from green electricity;

- Blue hydrogen: produced from fossil fuels with carbon capture and permanent storage (carbon storage) or utilization of captured carbon emissions (carbon utilization).

- Residual heat.

Electrification (for example, making a natural gas-powered process electric)

Do not qualify:

- Solid and liquid biomass not meeting RED II sustainability criteria

- Ambient air (example: air-powered heat pump)

- Landfill Gas

- PV panels, wind turbines, or other ways to produce electricity

Theme energy efficiency

Investments to use energy more efficiently for the company's core activities are also eligible. Core activities are activities that are primarily production-related. They may include, for example, modifications to the production process, thermal storage, ...

What doesn't qualify?

- Technologies that do not exceed the standard such as thermal insulation, more efficient lighting, speed control of compressors, building management systems, making the fleet more sustainable, powering solar panels.

- Investments only related to the building, fleet, ...

- Investment in new fossil technologies, unless it is about upgrading waste heat.

How much is the support ?

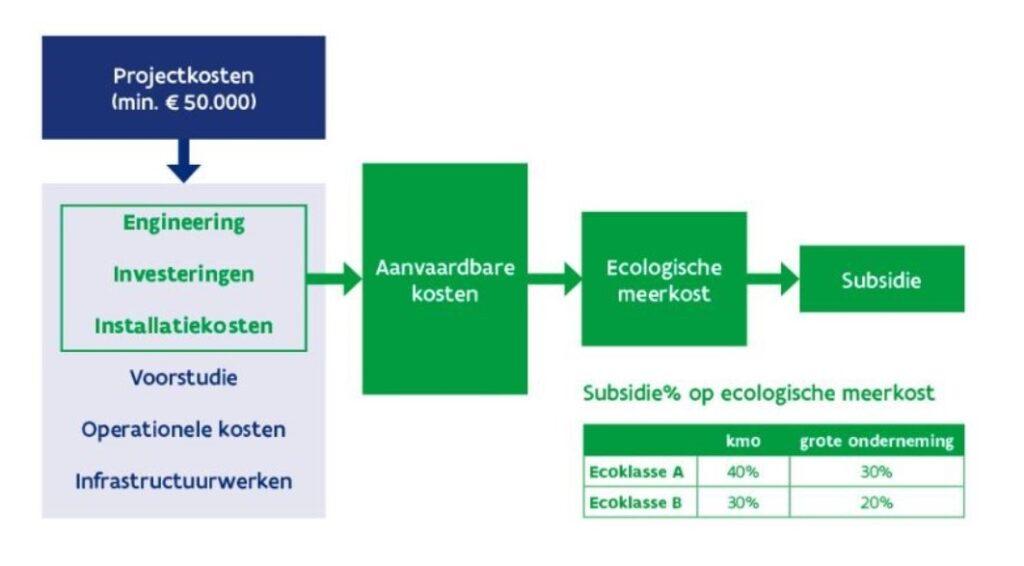

Depending on the size of the company and the eco-class (A or B) of the investment project, the support is 20%, 30% or 40% of the ecological additional cost.

Projects that achieve high cost-effectiveness (KE) (high environmental benefits per euro invested, KE ≥ 1.5) belong to eco-class A.

Projects that achieve lower (but still sufficient) cost-effectiveness (KE 0) belong to ecoclass B.

The ecological additional cost is the cost of the additional investment (excluding VAT) necessary to achieve the environmental objectives. The additional investment is calculated by comparing the ecology investment with a conventional investment that is technically comparable, but with which the same level of environmental protection cannot be achieved (= the standard investment). The comparison is made on the basis of equal production capacity.

How to apply ?

The application must be submitted digitally via the portal of VLAIO.

To apply, however, you must mandatory login for a preliminary discussion with a VLAIO business advisor. After this meeting, you will know whether your project has a chance of being granted a subsidy and, if so, what the points of interest are for your project in order to prepare a good subsidy application.

Do not hesitate to contact us here contact us with questions.

Would you like a conversation about the right approach for your business? Then make an appointment here with our pro experts!

Wallonia

A budget of EUR 175 million was made available to provide direct support to companies affected by the sudden increase in energy prices.

Per quarter, the following modalities apply:

| Category | % support | support ceiling | terms |

| Non-energy-intensive businesses within the meaning of the temporary aid framework | 25% | EUR 500,000.00 | Decrease in operating result compared to the reference period of year n-1 and implementation of an energy audit within 3 years |

| Energy-intensive enterprises (=where the purchase of energy products is at least 3% of production value) | 30% | 4,000,000.00 EUR | Eligible costs are at least 50% of the operating loss. The support shall not exceed 80% of the operating loss in the period concerned. |

| Highly energy-intensive companies (e.g., aluminum, fiberglass, pulp, fertilizer, hydrogen and chemical companies) | 35% | 7,500,000.00 EUR |

It will be granted for the fourth quarter of 2022 and for the first quarter of 2023 if the temporary framework is extended.

The aid rate is applied to the difference between the invoice for the relevant period (quarter) and twice the invoice for the corresponding period of the previous year.

Example:

- Invoice quarter 4 2021: EUR 3,000

- Invoice quarter 4 2022: EUR 10,000

- ➜ calculation base = 10,000 EUR - (3,000 EUR X 2) = 4,000 EUR

- ➜ support is 25% of 4,000 EUR, i.e., 1,000 EUR.

In addition, the grant is subject to the following further conditions :

- Annual energy bills must exceed EUR 7,500 by 2021;

- The company may not claim economic unemployment of more than 35% over the previous year's reference period;

- The company may not pay dividends to shareholders in the year in which it receives the aid, and the aid granted may not be valued in connection with the payment of any dividend relating to the fiscal year in which the aid is granted.

The Walloon energysupport will be available to apply from Feb. 6 to March 5 at the online platform provided for that purpose.

Do not hesitate to contact us here contact us with questions.

Would you like a conversation about the right approach for your business? Then make an appointment here with our pro experts!