On July 21, the ECB will raise interest rates for the first time in a long time in order to halt rising inflation. But what does this mean for you as an entrepreneur? We give you an overview of what inflation means, how rising interest rates will affect your business and what options you have to protect yourself against it.

What is inflation?

Inflation is an increase in the general level of prices in the economy. The cause of inflation can be found in the demand for products and services. If the demand in a country increases, this will lead to an increase in the general price level. In addition, inflation can also be amplified by macroeconomic factors such as wars, political crises or revolutions. An inflation rate shows the average increase in prices over a given period.

If there is no inflation, the incentive for immediate consumption falls away, which slows down the economy. On the other hand, too much inflation makes investing more expensive, which also slows down the economy.

A limited level of inflation is appropriate to encourage consumers to consume and invest. The European Central Bank (ECB) therefore aims for a stable annual inflation level of 2% to create confidence in the value of money and promote sustainable economic growth.

Interest rates as a tool for higher stability

To pursue a stable pricing policy, the ECB has various monetary tools at its disposal, with interest rates being the most widely used. In this way it can influence the cost of loans and thus investments. Raising interest rates slows down investment and reduces the general demand for products and services. This in turn has an impact on prices and thus inflation.

The inflation rate in May 2022 was 8.97% annualized, the highest level of inflation since 1982. The ECB is trying via an increase in the policy interest rate to reduce the level of investment and thus slow the rampant inflation.

The policy rate imposed by the European Central Bank (ECB) today is -0.50%. The ECB announced that the policy rate will rise to -0.25% on July 21, 2022. The ECB is expected to raise the policy rate further, following the lead of other central banks such as the US Federal Reserve (Fed).

What types of interest rates exist?

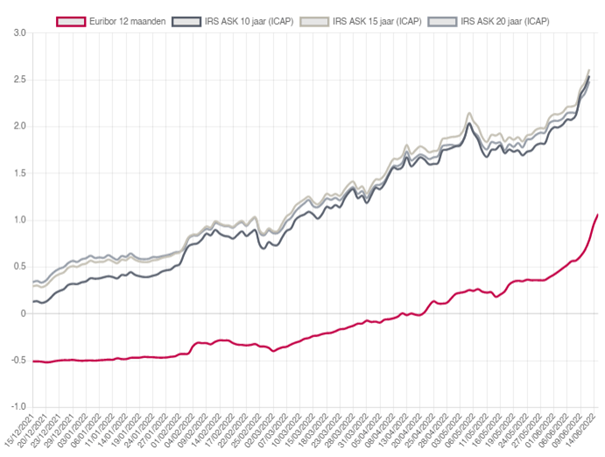

For the pricing of short-term loans, the EURIBOR is used as the reference rate. This EURIBOR is subsequently increased by a commercial margin.The straight loan withdrawal rate is already 1% higher than the end of 2021 in certain cases, depending on the maturity of the withdrawal. Adjusting the maturity of straight loan withdrawals to suit your needs can reduce the cost.

The pricing of long-term loans is based on a long-term interest rate (e.g. IRS), increased by a commercial margin. For a long-term investment loan today, count on an interest rate 2% to 3% higher than an interest rate obtained at the end of 2021.

How do you arm your business against the effects of interest rate increases?

All macroeconomic indicators point to a further increase in the interest rate in the near future. Therefore, it is appropriate to make your investment projects concrete before the interest rate rises further.Entering into a credit contract at a relatively low interest rate at the present time can avoid higher interest rates.

You can also use financial products to protect your company against interest rate rises for both long-term and short-term loans (for more information about the various hedging possibilities, we refer you to this item). The price for these products is highly dependent on the market. For a concrete proposal it is best to talk to your contact person at your bank.

Do not hesitate to contact us here contact us with questions.

Want to know more about which structure or approach is most appropriate to protect against these interest rate increases? Then make an appointment here with our pro experts!